3 Things I've Learned About Small Innovations

Banks eager to for transformation must recognize the key roadblocks to their achieving small innovations. These are the innovations that will really transform your bank.

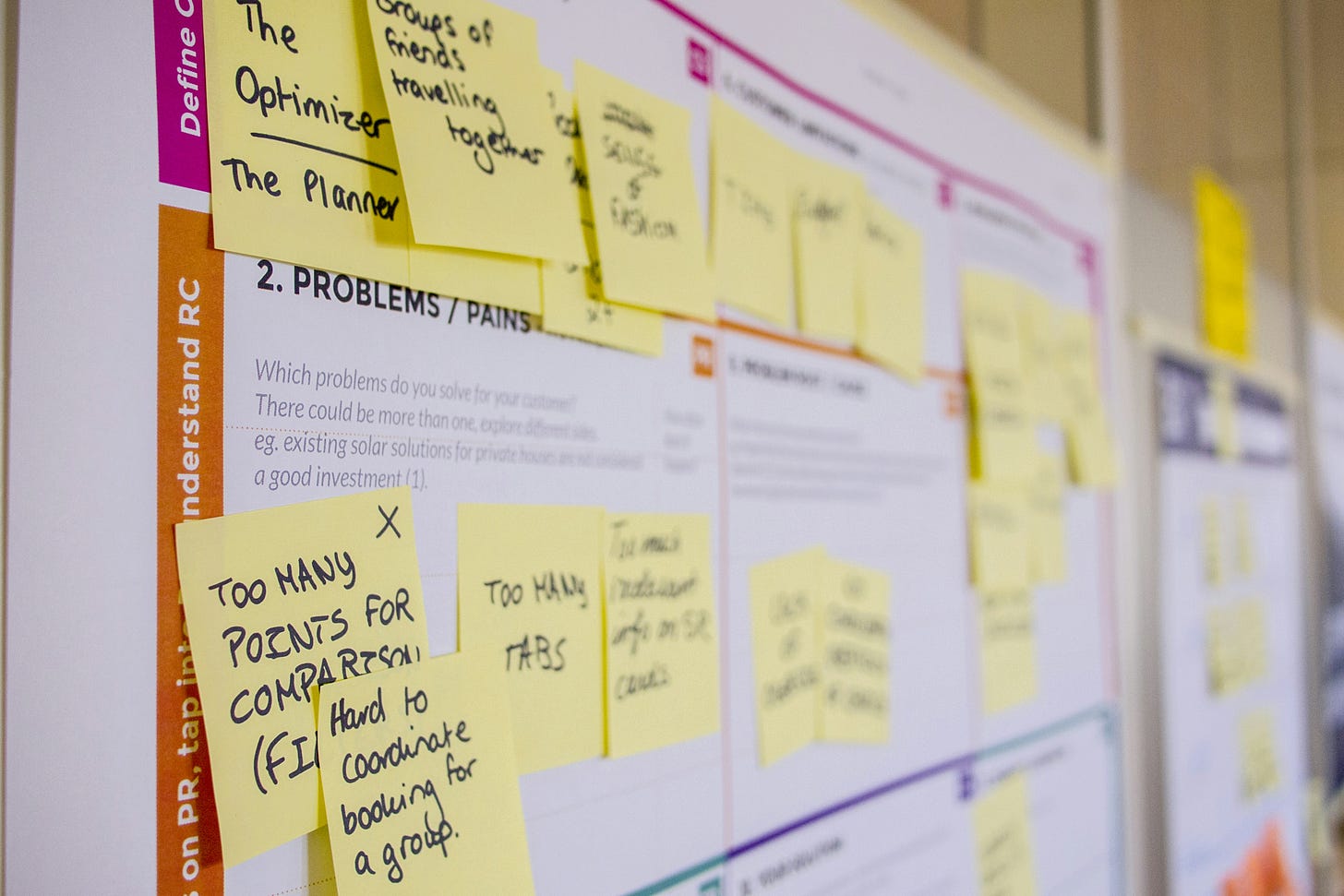

Photo by Daria Nepriakhina 🇺🇦 on Unsplash

Three Things Banks Must Do To Succeed in Innovation

I’ve been a proponent of financial institutions pursuing small innovations over a large transformation projects. During the last year I’ve learned a few things from my work with a large bank. The senior executive management of this bank was driving the new digital transformation strategy. They were well aware of the business forces operating in their environment, that the had to accelerate digitalization- if only to protect their current customer base, much less push past their traditional bank competitors and compete with the many emerging fintech, payments, and bank players in their ecosystem.

Do just enough analysis to avoid paralysis

Move fast to identify your first project

Incorporate as much agile as possible

Is this everything a bank must do? Certainly not. A quick search anywhere will give you oodles of advice, strategies and steps you should consider and include in your innovation journey. These are, however, key points of potential roadblocks to achieving small innovations — the innovations that together will transform your bank.

Do Just-Enough Analysis to Avoid Paralysis

Bank innovation teams (or other groups) start transformation projects with the best of intentions: to uncover and document the problems and challenges with the FI’s current strategy, processes, products, services, channels, transaction processing……. The whole ball of wax.

A 30,000 foot (or 9,144 meters) view of the landscape is helpful for an innovation project Your team’s drilling deep into every business unit, channel and technology group might yield nuggets you weren’t aware of. I am an analyst so I’m obviously not against analysis. But, the number of problems that you uncover everywhere - from back office systems to branches - can also lead to organizational overwhelm and paralysis. How can we address all these problems? Shouldn’t the first project be bigger, fix more stuff, be more transformational?

The urgency to fix all the problems: huge. The temptation to take on a large digital banking transformation project that will fail: huge.

Here’s where the “transformation project” gets bogged down. Lingering too long in analysis and its side-kick paralysis can uncover a lot of challenges, broken processes and lead to complete overwhelm. If your FI focuses on small innovations, you can do just enough analysis and documentation and move on. You can do more analysis for the next project and the next.

Move Fast to Identify Your First Project

The digital or innovation team must not yield to the temptations of over-analysis and/or paralysis in their effort to identify - and quickly - a small innovation. This project is not hard to find. It’s often a problem that someone or group in your organization is already well aware of.

Look for the Not-So-Hidden - Tribes

I’ve written quite a bit about how financial institutions must uncover new product and services opportunities by identifying hidden tribes within (or external to) their existing customer base. But, sometimes these tribes are hiding in plain sight.

Photo by Ali Hajian on Unsplash

For example, the aforementioned bank had a large subset of small business customers who in turn had many challenges in performing trade-related banking and payments activities. During the analysis stage, these areas were quickly identified as holes in the bank’s current products and services - either in-person or digital - to assist these customers. I am not suggesting that this is a “quick fix.” There are likely reasons that these services don’t yet exist. But, why look further than this not-so-hidden group of small business customers whose needs were not being met for new product and service opportunities?

Incorporate as Much Agile Development as Possible

Agile development and culture is important to the ongoing sustainability of a innovation in a financial institution. FMany FIs of all sizes have adopted agile development tools and strategies. But waiting for the entire organization to adopt agile before embarking on a small innovation project will likely result in paralysis. If your FI waits, project owners, evangelists and management supporters will, ultimately, move on to other, more pressing projects and initiatives that demand their attention, time and budget.

This does not mean you have to move forward on your first project without agile. Acquire and adopt as much agile development and culture as you can for this project. It may not be a pristine agile project. But this initial, imperfect agile project can accomplish not-so-small goals:

Small innovations fix problems that are closest to your customers.

Small innovations prove to your business and IT staff that your institution can implement change. This accomplishment can shift attitudes towards transformation from skepticism towards optimism and acceptance.

Small innovations prove to your customers or members that your institution can listen – and more importantly – respond to their needs. Don’t just talk about being responsive, be responsive in tangible ways.

Small innovations boost morale. This is especially crucial right now, when people are resigning from their jobs and finding new ones that better meet their needs.

Small innovations let you introduce new technologies and capabilities in manageable quantities. Total transformation of development methodologies take time. By introducing technologies in small innovative changes, IT and business teams can get used to that change.

Small innovations let you bring in new ideas that don’t disrupt the entire

organization.

Small innovations mean the consequence of failure of some of those innovations isn’t that big.

Small innovations mean you can pivot from failure to success or just dump an idea that doesn’t work.

Small innovations can enable you to disrupt a commodity product or service that costs you money, like bill pay.

Small innovations can uncover more opportunities for innovation.

Takeaways:

Financial institutions:

Analyze and move on. If your team spends months analyzing current processes and technologies, you may be on the verge of a transformation project. If you are looking for small innovations that will make a difference, do just enough analysis and move on to identify a project.

Quickly identify a first small innovation. I know, the first innovation project is so important. Will it achieve the goals I listed above? Will it drive profitability? So many questions. But it’s likely that the first project is pretty clear - from your analysis and other information. For example: Is your online or mobile banking app hard to use? Do you have any documentation - emails or other messages from customers (internal or on social media) that one or both of these services are terrible? What does terrible mean? Do customers abandon the mobile app to call or go into the branch to get services? Ron Shevlin has made some good points a while back about this “phenomenon.”

Include not-so-hidden tribes. Identifying a hidden tribe that will benefit from a small innovation project is not necessary - especially if you are fixing a problem that impedes customers from using a specific channel or product. However, one you have fixed these problems or challenges, you probably don’t have to dig too deeply to identify a not-so-hidden tribe that is not getting services they want and more importantly, need.

Fintechs, digital banking vendors and services providers:

Does your solution enable innovation teams to use third party agile tools for developing new capabilities?

Can your solution demonstrate benchmarks for small innovations for your FI customers?

Is your company creating its own internal small innovations? What are your latest small innovations? Do you get bogged down in over-analysis?

Do you facilitate small innovations? Be honest: Does your go-to-market strategy include small innovations or are you pitching only large transformation projects. Your solutions and services may support small innovations - but you don’t know it (hint: I can help you with that).

Who writes PivotAssets?

I’m an independent analyst, strategic advisor & consultant (& a former Gartner analyst). I’ve worked in and covered the banking industry for over 2 decades.

My aim is not to confirm what you know (and you are plenty smart!) but to challenge you & give you a fresh perspective & analysis on the transformation that is —and isn’t happening - in the industry.

How can I help you?

Want more insights and analysis on hidden tribes and leveraging your bank’s legacy? Need help positioning your digital banking solution or fintech to meet the demands of today’s banking environment? I have my own firm PivotAssets.

To collaborate with me - whether you want analysis of and feedback on your GTM strategy or sales presentation, write a piece of thought leadership relevant to your business, or want someone to organize and moderate a webinar series, podcast or panel, please contact me at stessa@pivotassets.co or via LinkedIn.

I’m also available for inquiry and strategy sessions via Third Eye Advisory.

Me, Elsewhere

I’m an expert advisor at Third Eye Advisory.

Theodora Lau, Barb Maclean, Efi Pylarinou and collaborated on this unorthodox, diverse perspectives about financial services & the year to come.

I spoke with Theodora Lau and Barb Maclean on their podcast One Vision about smart banking & hidden tribes.

I moderated a great panel of folks for a conversation on innovation. We cut through the hype and share practical advice for making your digital transformation efforts pay off. We definitely talked about the importance of small innovations.

How can banks be truly low friction? They must address friction everywhere. Otherwise innovation & digital transformation will elude them. In this report I identified the characteristic of a low friction bank and why legacy core banking and architectures don’t support it.

What can the Kardashians teach your financial institution about partnerships and innovation? How can working with empathic fintechs help you identify niche groups (aka hidden tribes) and innovate. All this and more in this this ebook that you can download at Praxent or Nymbus.

Adopt an Agile Digital Banking Platform: How bankers must have an agile digital banking platform to support both global and local trends and requirements to help them identify new niche markets that will drive innovation, create new value and increase profitability. In this report I identified a set of capabilities that a digital banking platform must have that will help take banks into a competitive future and urges banks to select a digital banking partner who shares their innovation, vision and support for new value creation.