Legacy Banks: Blessing or Curse

Every day another banker notices how Stanley's profits shot up when they targeted women & partnered, well, with Target. Is legacy a blessing or curse for FIs?

Photo by Etienne Martin on Unsplash

Bankers, people who work with and for banks, credit unions and community banks - all of us are all aflutter about the spectacular Stanley-110-year-old company-consumer-viral-moment.

I get it. I got this in early December and now it sits on my desk and goes almost everywhere with me.

Several folks in the financial services world have taken notice and written about what the Stanley phenomenon might mean - or doesn’t mean - for financial institutions.

Matthew Sekol wrote a thoughtful analysis from an ESG perspective that is easily lost by the profit growth data and trendiness of Stanleys.

If you’ve met me, you’ll know I am not very built, but the men I worked with were tough. I remember a few of them would carry giant green Stanley mugs full of coffee. As a result, like many, I associate the Stanley brand with hard-working blue-collar workers.

Imagine my surprise to see hot pink and red Stanley mugs selling out at Target stores all over the US last week!

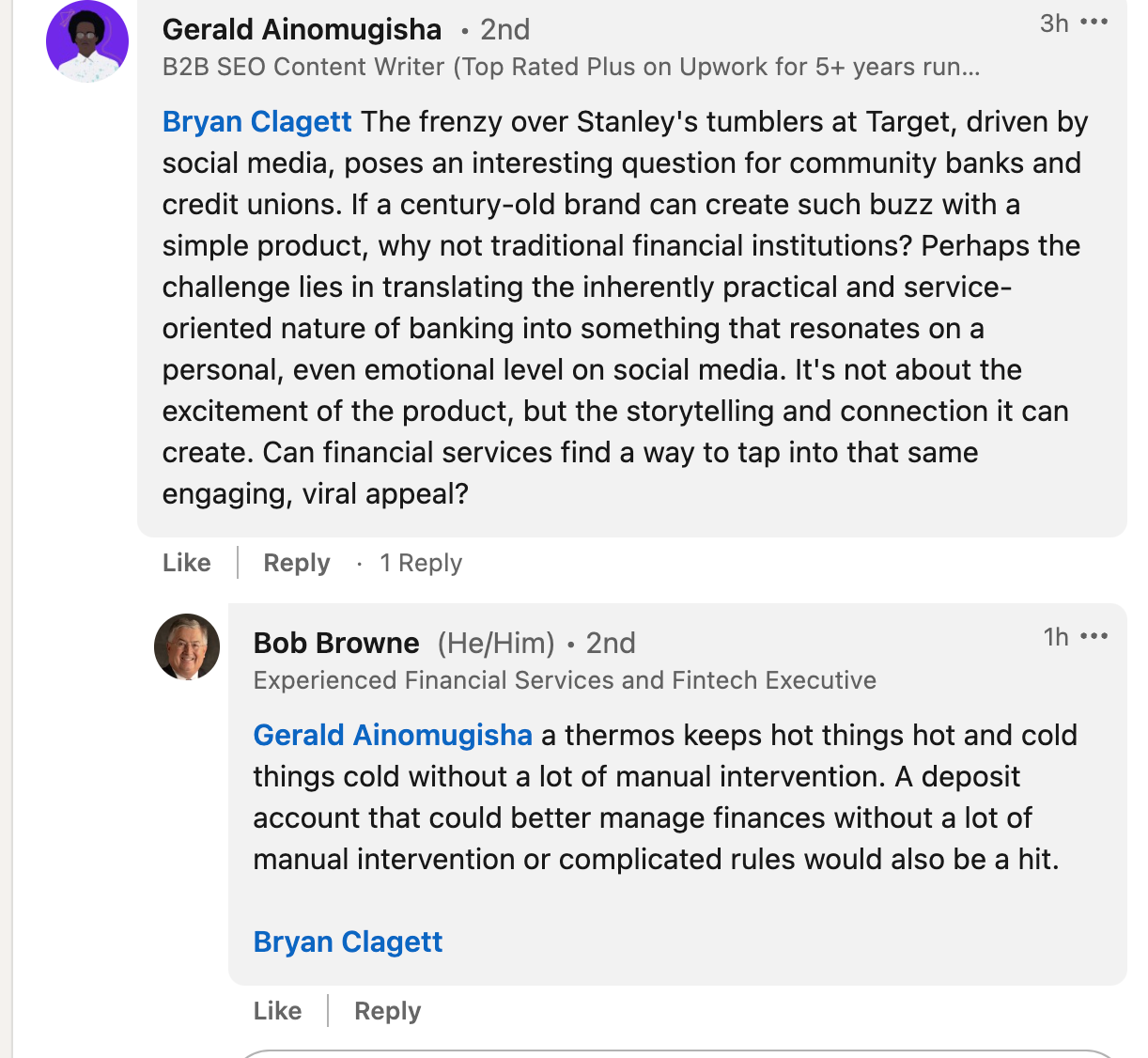

Bryan Clagett makes a good point that banking might be more boring than Stanley cups. His post generated lots of great comments including these two.

You should read them.

I don’t disagree with any of these fine analysts, commentators and writers.

Is Legacy a Blessing or a Curse?

I think that the Stanley phenomenon is big news in banking because it gets to the core of what many if not all banks, credit unions and community banks struggle with every day: the value of legacy.

Financial institutions have yet to figure out if being a legacy institution is a blessing or a curse.

This confusion shows up in the questions that banks, credit unions and community banks focus on:

Should we create a new challenger bank and brand to appeal to Gen Z?

Should we get rid of our branches because branches are so “legacy”

Should we be more like Uber/Tesla/Stanley ?

How do we get more, younger customers or members?

How can we make our FI more relevant? ESG? DEI? Green loans?

And, from the data recently posted by Glenn Grossman at Cornerstone, despite all these questions and struggles, in 2024 credit unions and community banks will focus on pricing strategies to attract and retain customers and member deposits. Which is a strategy that relies on the legacy value of banks.

This pursuit of pricing seems similar to the play by Comcast/Peacock to force people who wanted to watch the Chief-Dolphins football game to buy the streaming service (that not enough people want to watch) seems like a "free toaster" gimmick for signing up for a new savings account/card/loan.

I don’t disagree with the data or even pricing strategies. But if that is all your FI is offering, are you really offering a relationship or just a free toaster and maybe a better rate?

How long until your new customers turn their heads to the next shiny offer?

Has your digital banking platform really transformed anything?

Are you creating products and services that address unmet needs?

What does concern me is that banks, credit unions and community banks avoid dealing with - and leveraging - the value of legacy.

Value of Legacy

Stanley cups aren’t the first boring legacy products to make a comeback. Take diapers, mundane diapers. In 1997, the New York Times declared that cloth diapers were just about extinct.

In 2017, cloth diapers have been slowly but definitely making a comeback.

…the results of a survey conducted in the United States in 2017 on attitudes towards reusable cloth diapers. Some 21 percent of respondents stated that they use reusable cloth diapers. The Survey Data Table for the Statista survey Baby Care in the United States 2017 contains the complete tables for the survey including various column headings. source: Statista

The rise of consumer interest in sustainability and climate/environment issues has also driven interest in cloth diapers.

Yes, the Statista data shows that the number of parents who actually use cloth diapers is less, much less, than 50%, but there is at least 1 national service in the US that cleans and delivers cloth diapers to your home. Which isn’t the same as the Stanley phenomenon. (or should I say yet?)

Along with the story of the re-emergence of legacy cloth diapers, the Stanley case tells bankers (and yes the vendors that supply them) that understanding the value of your legacy is foundational to your ability to identify niche groups and products and services for them.

Takeaways:

For financial institutions:

To take advantage of the opportunities of legacy, FIs of all kinds must ask themselves the following questions:

What is your legacy to your customers? What do your customers or members like about your institutions? What do they say you do well? I’m not talking just about your mobile app. Is there a community or member event or service that people like, show up for or enjoy? Citizens Bank of Edmonds is particularly good at showcasing this aspect of their bank. Credit unions and community banks have a leg up over retail banks. Your missions are rooted in the actual neighborhoods and lives of your customers and members.

Who in your community or membership areas has benefited from your financial services? Why?

Who are the people and businesses that are not well served in your community whether they have accounts at your FI or not? Don’t limit yourself to traditional demographics. Look for hidden tribes.

Legacy can take you only so far. One of the lessons of the Stanley phenomenon is that Stanley didn’t do it alone. They had help. You’ll also need to identify

New partners - especially those out of your comfort zones

Hidden tribes. If you don’t find them in your own data, you should look outside. Stanley didn’t find new customers amongst their existing customers. You can’t find them simply by copying another bank or consumer brand.

Where are those hidden tribes?

Photo by Random Institute on Unsplash In a previous issue, I wrote about hidden tribes – a term that I borrowed from Rick Wilson that describes new ways of viewing people in a political party. I suggested strongly that digital banking solutions and bankers must adopt this framework for identifying new customers and products/services.

For fintechs and digital banking vendors:

How does your solution, fintech, API, embedded banking or payment capability enable FIs to leverage their legacy value?

Does your solution or fintech support different legacy values?

As you ponder the Stanley phenomenon and how it applies to your financial institutions, identify the value of your legacy. Weave it into your strategy. Whether it’s a blessing or a curse, you can still use it. Just ask Stanley.

Who writes PivotAssets?

I’m an independent analyst, strategic advisor & consultant (& a former Gartner analyst). I’ve worked in and covered the banking industry for over 2 decades. I write about digital banking in this newsletter - not to confirm what you know (and you are plenty smart!) but to give you a fresh perspective & analysis on the transformation that is —and isn’t happening - in the industry.

How can I help you?

Want more insights and analysis on hidden tribes and leveraging your bank’s legacy? Need help positioning your digital banking solution or fintech to meet the demands of today’s banking environment?

To collaborate with me on a similar project or something else completely different whether an analysis of your GTM stragey, analyst briefing presentation, a webinar series, podcast, panel, please contact me at stessa@pivotassets.co or via LinkedIn.

I’m also available for inquiry and strategy sessions via Third Eye Advisory.

Me, Elsewhere

I’m an expert advisor at Third Eye Advisory.

Theodora Lau, Barb Maclean, Efi Pylarinou and collaborated on this unorthodox, diverse perspectives about financial services & the year to come

I spoke with Theodora Lau and Barb Maclean on their podcast One Vision about smart banking & hidden tribes.

I moderated a great panel of folks for a conversation on innovation. We cut through the hype and share practical advice for making your digital transformation efforts pay off. We definitely talked about the importance of small innovations.

How can banks be truly low friction? They must address friction everywhere. Otherwise innovation & digital transformation will elude them. In this report I identified the characteristic of a low friction bank and why legacy core banking and architectures don’t support it.

What can the Kardashians teach your financial institution about partnerships and innovation? How can working with empathic fintechs help you identify niche groups (aka hidden tribes) and innovate. All this and more in this this ebook that you can download at Praxent or Nymbus.

Adopt an Agile Digital Banking Platform: How bankers must have an agile digital banking platform to support both global and local trends and requirements to help them identify new niche markets that will drive innovation, create new value and increase profitability. In this report I identified a set of capabilities that a digital banking platform must have that will help take banks into a competitive future and urges banks to select a digital banking partner who shares their innovation, vision and support for new value creation.