Rotting Products? Don't Whine, Innovate!

Decoupled products & services is a sign of product rot - whether they are your FI's products or someone else's. FIs can also view these examples - and others - as opportunities for small innovations.

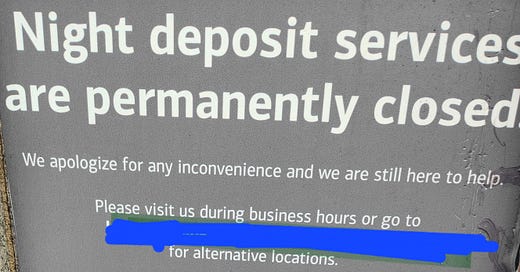

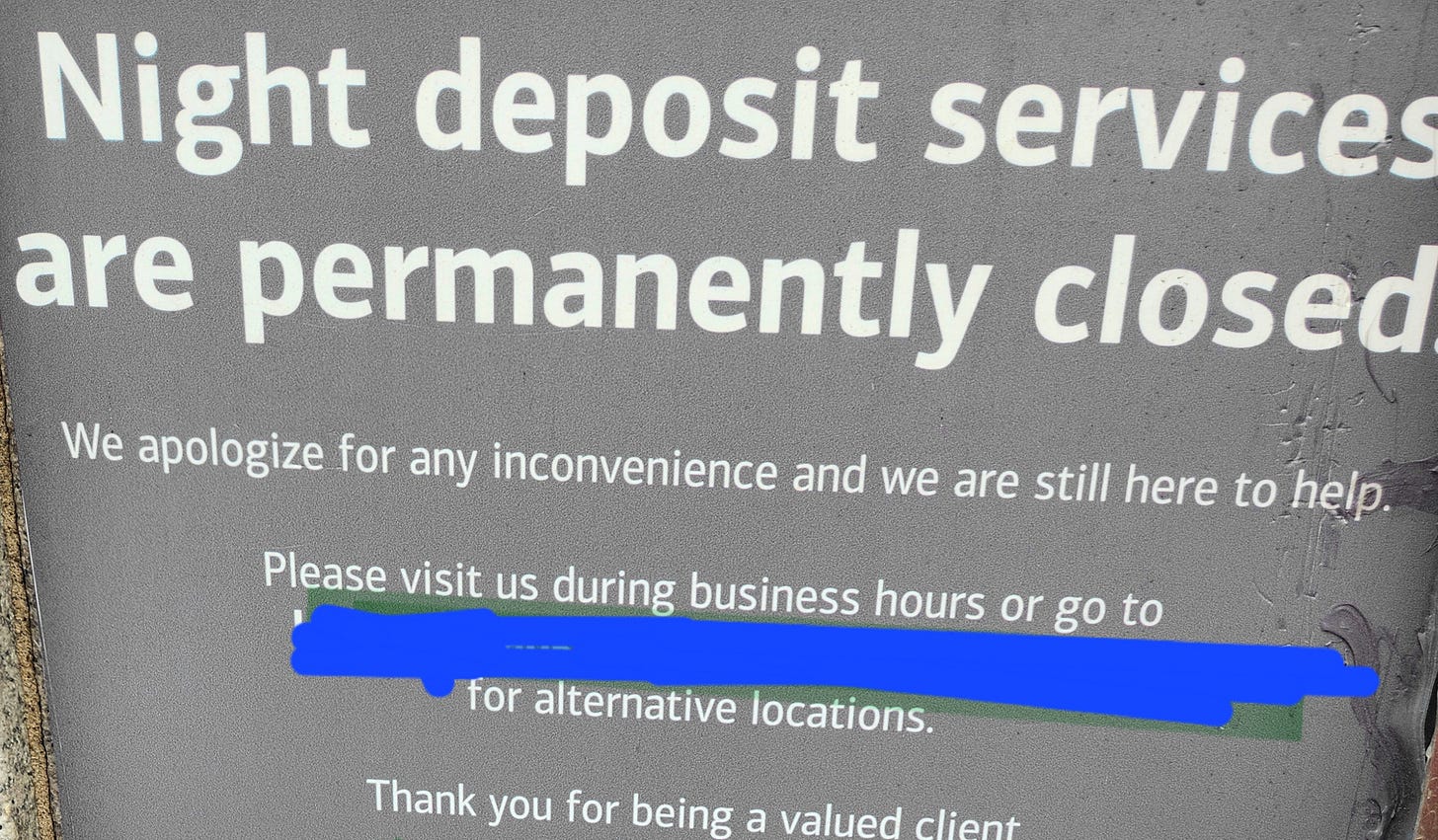

Photo by Stessa Cohen

Suddenly the decoupling of products from service – and the accompanying product rot is everywhere. Once you know what it is, you can’t unsee it. In fact, financial institutions do not have to look too far to see signs of product rot.

Decoupled Products are Everywhere

Since I wrote this newsletter, I’ve come across more examples of products decoupled from service. But FIs can do more than just focus on these examples of product rot. FIs can also view these examples - and others - as opportunities for small innovations.

Cash deposits

I came across the sign above in a small town in Pennsylvania, a small town full of small business that are open weekends, evenings and other times that are not the same “business hours” as the bank branch. FIs seek to grow their SMB customer base, yet stop existing services such as cash deposits after branch hours. I hope one of the smaller, local banks or credit unions in town pick up on this loss of service.

Paper Checks to Direct Deposit

In the US, there's an order to stop paper Social Security payments in September. I had no idea that 462,000 people in the US still receive Social Security benefits by paper check delivered by the US Postal Service. Axios created a great map showing number of recipients who get paper checks by state. Moving everyone to direct deposit is not a bad idea. It’s a good idea. If only because according to the FBI and the US Postal Inspection Service more and more check fraud occurs via mail theft. And, some post offices may be closed. However, before then, Social Security phone support for recipients is going away in April. Those recipients who want to move to direct deposit may or may not have a Social Security office nearby or the means to get to an open office or the ability to wait hours in a queue for that service. If someone still gets a paper check, chances are they aren't going to able to or want to deal with a website to make these changes.

These kinds of disjointed, uncoordinated changes will impact your customers. I suspect your call center volume and branch traffic will increase with customers who still receive paper checks will need information to move to direct deposit. If you've ever helped an elderly parent manage anything with a computer or smartphone, you can already imagine the anxious questions: What is a routing number? How do I find my account number? Is this safe? I can’t see the screen on this phone! Can I make the text bigger? How? How do I know the Social Security got my changes? I want to call to confirm “they” got it.

There are many other challenges recipients could face including: What if the recipient doesn’t have a smartphone or computer? Or internet connectivity? Or secure connectivity?

Expanding BNPL

What started off as an alternative payment method for low value payment that the customer might otherwise use a credit card or a debit card, BNPL is rapidly expanding from consumer purchases such as clothes or appliances to food delivery and auto purchases. However, the product still lacks any real customer services – until a customer misses a payment for a long forgotten meal or new car. Many also anticipate that upcoming auto tariffs in the US will be a boon to BNPL in auto financing. With all the BNPL creep, as I mentioned in my previous issue, no one helps customers manage various BNPL accounts and payments — or to determine if they should be using that payment method at all.

Identify Opportunities for Customer Service & Innovation

With the advance notice that the US Federal government is going to discontinue paper Social Security checks, FIs in the US can prepare for these changes & offer services to support their customers who receive paper checks. In fact, they have an opportunity to convince the most digital-reluctant customers you have not only to move to direct deposit but to try mobile or online banking.

Use the information you have to identify customers who receive monthly paper Social Security checks.

Create both online and in-person workshops for those customers to explain how to move from paper checks to direct deposit. Some of the topics you can cover might include:

Explain why direct deposit is safe.

Provide routing number and account number information and other information customers will need to set up direct deposit through Social Security. Show them how to find it on their paper checks.

Set up notifications in their accounts to send customers notice (phone call, text message, email, whatever options are available at your FI) when the Social Security deposits (paper or direct deposit) hit their accounts and when customers can use the funds.

Show them how to use mobile or online banking if they don’t already – and how they can pay bills electronically rather than writing paper checks that can get stolen. Be prepared to work one-on-one with customers.

Offer to show them again if they get home and forget how to do something. Give them a branch manager’s card with contact info so they can contact a human.

Offer appointments for customers who can’t make the workshop to come to a nearby branch, video conference.

I’m sure there are plenty of other things you can do that I haven’t even thought of.

Are there other instances where customers need help - whether with banking or another activity that intersections with banking or payments?

Do you have other customers who still receive and deposit paper checks? If this small innovation helps Social Security payment recipients, adapt these services to those hidden customer tries.

Takeaways

Expand your scope to identify product rot outside of your FI that impacts your customers. These are opportunities for your FI to create small innovations to create new & real value for your customers.

After you’ve determined which products/services are broken, identify ways to bring service to your customers.

Create service - whether it uses technology or a human via self service channels or or in-person.

Who writes PivotAssets?

I’m an independent analyst, strategic advisor & consultant (& a former Gartner analyst). I’ve worked in and covered the banking industry for over 2 decades.

This newsletter is designed to challenge you & to give you a fresh perspective & analysis on the transformation that is —and isn’t happening - in the industry.

How can I help you?

Want to discuss product rot, small innovations, ghosting customers, hidden tribes and leveraging your bank’s legacy? Need help positioning your digital banking solution or fintech to meet the demands of today’s banking environment? I have my own firm PivotAssets.

I can analyze your GTM strategy or sales or VC presentation, help you prepare for your first vendor briefing or your first funding pitch meeting. I also write piece of thought leadership relevant to your business, solutions or technology. I also organize and moderate webinars series, podcast or panel.

Contact me at stessa@pivotassets.co or via LinkedIn.

I’m also available for inquiry and strategy sessions via Third Eye Advisory.

Me, Elsewhere

Ivo Spigel & Nick Holland and I are working on FinVino, which will debut in May, 2026.

Did you miss the last Fintech Book Club? Follow our LinkedIn page to make sure you’re part of the club on 11 April.

I’m an expert advisor at Third Eye Advisory. Ready to help your company or financial institution:

Lead with problem solving

Develop Value-Driven Customer Experiences

Build Product Innovation & Differentiation

Create Strategic Intelligence for Investors.

I spoke with Theodora Lau and Barb Maclean on their podcast One Vision about smart banking & hidden tribes.